Why Carbide Tool Costs Changed in 2025: Understanding the Tungsten Market

Table of Contents

In 2025, the global tungsten market entered a new phase. Prices across the entire upstream chain—ranging from ore and intermediate compounds to tungsten powder and tungsten carbide—moved significantly higher and remained firm throughout the year.

For customers using solid carbide end mills, drills, and inserts, this shift had a direct and visible impact on tooling costs. Importantly, this was not a short-term fluctuation or a temporary supply disruption. It reflected a structural change in tungsten market conditions, with lasting implications for carbide cutting tools.

This article explains why these changes occurred and how they affected carbide tooling from a material and industry perspective.

Tungsten’s role in carbide cutting tools

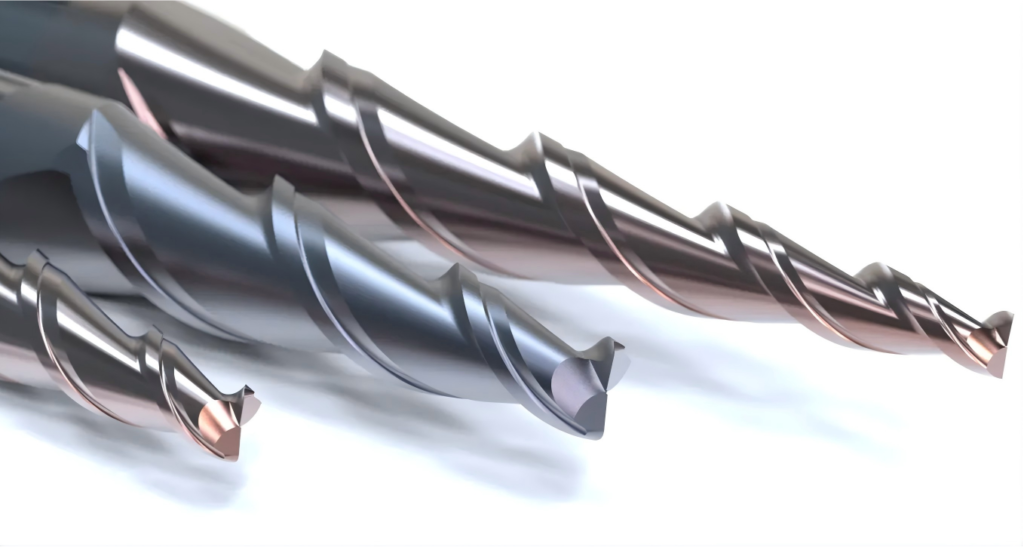

Tungsten is the core element of tungsten carbide, which forms the backbone of modern carbide cutting tools. Whether in milling, drilling, or turning applications, the performance characteristics that users rely on—wear resistance, hot hardness, and dimensional stability—are all tied to tungsten-based materials.

The carbide tool supply chain typically follows a layered structure:

- Tungsten ore and concentrates

- Chemical intermediates such as APT

- Tungsten powder and tungsten carbide powder

- Carbide rods, blanks, and inserts

- Finished cutting tools

While market discussions often focus on ore or APT, carbide tooling costs are most sensitive to powder and carbide-grade materials. These stages involve tight quality requirements, limited processing capacity, and strong coupling between supply availability and tool manufacturing output.

In 2025, pressure accumulated at every stage of this chain.

A year of full-chain re-pricing

One defining feature of 2025 was that tungsten price movements were not isolated to a single product or segment. Instead, the entire upstream structure experienced re-pricing in parallel.

Rather than following a gradual inflationary pattern, the market showed a step-change behavior. Prices moved upward in stages and then stabilized at higher levels. Once these higher levels were established, the market did not revert to earlier conditions.

For carbide tool buyers, this matters because step-change markets tend to reset cost expectations. When upstream materials re-price structurally, tooling costs also adjust structurally, rather than temporarily.

Why tungsten prices remained firm

Constrained upstream supply

Throughout 2025, tungsten supply remained fundamentally tight. The availability of raw materials was limited, and the release of upstream resources was controlled. This restricted the volume flowing into downstream processing stages.

In addition, some processing facilities reduced operating rates or adjusted production schedules. This further constrained the availability of chemical intermediates and powder-grade materials, reinforcing firmness across the supply chain.

In such conditions, even moderate demand can support higher price levels.

Elevated production and processing costs

Tungsten processing is capital-intensive and highly sensitive to operating costs. In 2025, production costs across mining, chemical processing, and powder manufacturing remained elevated.

When cost structures rise across multiple layers, upstream producers have limited flexibility to reduce pricing. Even when downstream demand becomes cautious, prices tend to remain “sticky,” because selling below cost is not sustainable.

This cost-driven rigidity was a major reason tungsten prices held firm during periods of lower transaction activity.

Market behavior and cautious purchasing

Another defining feature of the 2025 market was cautious behavior on the downstream side. Alloy producers and carbide tool manufacturers increasingly shifted toward order-driven purchasing rather than speculative inventory building.

This resulted in a market with firm price levels but reduced liquidity. Transactions became more selective, and volumes moved more carefully, even as nominal prices stayed strong.

From a customer perspective, this environment can feel counterintuitive: prices remain high even though buying activity slows. However, this is typical of markets where supply is tight and cost pressure is high.

Direct impact on carbide cutting tools

Tool pricing reflects material fundamentals

Carbide cutting tools are materially intensive products. Tungsten-based materials represent a substantial portion of the total manufacturing cost, especially for solid carbide tools.

When upstream tungsten materials undergo a broad re-pricing, tool manufacturers cannot fully absorb the impact. Even with efficiency improvements, the scale of raw material changes in 2025 exceeded what could be offset internally.

As a result, tooling prices increasingly reflected material fundamentals rather than short-term commercial decisions.

Different products, different sensitivity

Not all carbide tools are affected in the same way by tungsten market changes. Products with higher carbide content or stricter material specifications are generally more exposed.

This includes:

- Solid carbide end mills with larger diameters or longer lengths

- Solid carbide drills, especially those designed for demanding applications

- Carbide inserts and wear components requiring stable grain structure and toughness

- Carbide blanks and rods used for custom or special tools

In contrast, products with lower carbide content or more flexible specifications may show less immediate sensitivity, although the underlying cost pressure still exists.

Lead-time pressure as a secondary effect

When raw materials are tight and expensive, manufacturers tend to manage inventories conservatively. This does not only affect pricing—it can also influence availability and delivery timelines.

In 2025, this dynamic became more visible, particularly for non-standard tools or specialized grades. The focus shifted toward stability and risk control across the supply chain.

Why tool performance mattered more in 2025

A higher tungsten cost environment changes how tooling value is evaluated. When material costs rise, performance consistency and tool life become more economically significant.

In practical terms, this means:

- Tools that perform predictably help stabilize production costs

- Stable geometry and suitable grades reduce unexpected failures

- Consistent quality becomes more valuable than marginal price differences

As a result, many customers placed greater emphasis on selecting tools that deliver reliable results under defined conditions, rather than focusing solely on initial purchase price.

Scrap and secondary markets support the new baseline

Secondary tungsten markets, including scrap and recycling, also reflected the higher value of tungsten in 2025. Scrap prices moved in the same direction as primary materials, reinforcing the idea that tungsten had established a higher underlying value level.

Secondary markets tend to react to real material economics rather than short-term sentiment. Their strength in 2025 supported the view that the tungsten market had shifted structurally, not temporarily.

Trade patterns under high material costs

High raw material prices also influenced international trade behavior. When upstream costs rise sharply, trade flows often adjust through reduced volumes rather than rapid price corrections.

This pattern was visible in tungsten-related trade during 2025, where movement became more selective and value per unit increased in relative terms. Such conditions further reinforced price stability across the supply chain.

What this means for carbide tool customers

The most important takeaway from 2025 is that tungsten entered a higher cost platform. While short-term fluctuations may continue, the conditions that drove early-2025 pricing are no longer present.

For carbide tool users, this means that tooling costs are more closely linked to raw material economics than in previous years. Price stability depends not only on demand, but on upstream supply discipline and processing costs.

Understanding these fundamentals helps explain why tooling prices adjusted in 2025 and why those changes should be viewed as part of a broader market shift rather than a temporary anomaly.

Closing perspective

Tungsten is the foundation of carbide cutting tools. In 2025, changes across the tungsten supply chain reshaped the cost structure of carbide tooling worldwide.

For customers, the key is not simply reacting to price changes, but recognizing the underlying material dynamics that drive them. In a high-cost tungsten environment, consistency, reliability, and long-term stability become central to managing overall machining costs.