The 2025 Tungsten Carbide Price Surge: What European Toolmakers Need to Know

Table of Contents

If you think carbide tooling prices are starting to climb on your end, you’re not imagining it. In 2025, tungsten carbide — the stiff material behind the toughest drill bits, end mills, and inserts — is already becoming noticeably more expensive..

It’s not a mere metal market’s flux. This is something nearly all manufacturers, buyers, and CNC professionals in Europe are feeling in their budgets as well as lead times. Its impact is real and growing from procurement planning to customer pricing.

So what’s behind the increase? And how can European toolmakers stay ahead without compromising on performance?

This guide breaks it down. You will learn what drives the change in prices, the impact on the ground on production, and what strategic steps to take to control operations and costs.

Why Tungsten Carbide Matters in Tooling

It’s tungsten carbide that makes modern machining possible at the scale and precision demanded by manufacturers. The material retains its shape and cutting edge even under immense pressure and heat, through the consolidation of tungsten with carbon into a dense, extremely hard compound.

It is used in CNC machining centers a lot, especially for cutting hardened steels, stainless, superalloys, and abrasive composites, since it maintains hardness at high temperatures and fights against changing shape. From car engine parts to aerospace-quality mounts, tools made from solid carbide or carbide-tipped blanks assist makers in attaining quicker cycle times and more exact standards without regular changes of tools.

For a lot of applications, tungsten carbide isn’t optional; it’s needed. And that’s just why the 2025 price jump is raising big talks all over the European tooling field.

What’s Driving the Price Increase?

Many factors, from world mining production to country rules, are making the availability and cost of Tungsten Carbide tighter.

Supply Pressure and Cost Impact by Factor

Factor | Supply Impact | Cost Impact | Relevance to Toolmakers |

Global Supply/Demand Imbalance | High (China-dominated market) | High (price of raw powder) | Affects raw carbide availability and grade diversity |

Energy Costs | Medium | High (sintering/furnace) | Impacts blank production, especially local EU suppliers |

Export Restrictions | High | Medium–High | Increases lead times and logistics complexity |

Geopolitical Influences | Medium–High | Medium | Causes uncertainty in pricing and trade agreements |

Environmental Regulations | Medium | Medium–High | Adds compliance cost and tool recycling requirements |

Global Supply and Demand

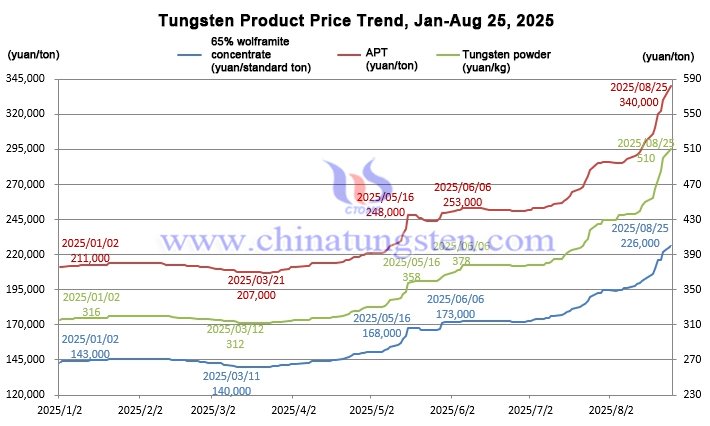

A large portion of the world’s supply of tungsten comes from just a few countries, with China alone accounting for more than 80% of raw tungsten production. Global demand has grown sharply, especially across aerospace, EV manufacturing, and energy sectors. At the same time, mine output hasn’t scaled at the same rate. That imbalance is pushing prices up. This means higher costs not just for raw carbide but for semi-finished blanks and pre-formed tooling components as well.

Shortages in certain grain sizes or insert geometries are already causing backlogs. With competition heating up globally, localized sourcing isn’t always an option, making proactive supply management a necessity.

Energy Costs

Processing tungsten into carbide isn’t energy-light. It requires extremely high temperatures and multiple sintering stages. As European energy prices fluctuate due to regional supply challenges and sustainability shifts, carbide manufacturing becomes more expensive, even before the material moves into tool production.

Many toolmakers report higher overheads directly linked to electricity and natural gas costs. This is especially relevant for smaller European producers who rely on domestic or nearshore sintering partners. Those who previously kept costs stable through long-term energy contracts are now seeing renewals at sharply higher rates. These cost hikes eventually reach the customer, embedded in the price of each carbide end mill set or tungsten carbide drill bits for metal.

Export Restrictions

The new export control rules on tungsten and molybdenum, made in early 2025, have remade how goods are sourced worldwide. These controls do not stop exports completely, but involve a detailed declaration and permission, which slows down the process and limits the quantities that can be shipped.

The European Union has called for more diversified supply chains in response, but building new procurement channels is a long-term play. Right now, manufacturers in Germany, France, and the UK are paying more just to maintain their usual volume. This bottleneck also limits access to specific grades and powder blends that are critical for carbide inserts, solid end mills, and high-speed production tooling.

Geopolitical Influences

As of 2025, global trade is still managing volatility. High tensions between principal tungsten-exporting countries and their buyers, along with variations in the post-pandemic rebound, have messed up the logistics as well as the supply pledges.

Some Asian producers are prioritizing domestic consumption. Others are tightening terms on strategic exports. For European firms, which rely on sustained good fortunes in their trade links and supplier relationships, this means added volatility and cost. Even if there is enough tungsten to satisfy needs, how long it takes to get it delivered has worsened, along with increased minimum order quantities. Geopolitical risk is also pushing up insurance and freight rates, particularly for specialized cargo such as raw or half-processed carbide tooling material.

Environmental Regulations

Sustainability efforts in Europe and Asia, plus emissions limits, energy efficiency mandates, and waste handling rules, have reached a point of driving up the cost of carbide-based tooling. Some facilities for mining and processing are now facing much stiffer compliance costs-as a better example-in the handling of by-products like ammonium paratungstate (APT).

Meanwhile, European rules on recycling and end-of-life tool care are adding more duty to the supply chain. These pressures, while good from a climate and resource view, do add to total cost structures. Firms ahead in clean making are putting money into closed-loop ways, but those new ideas need capital and time to scale.

The regulatory mandates of the EU Green Deal and REACH are evolving, which essentially means that CNC toolmakers are thrust into new audits with an entirely different process of documentation and traceability standards. These factors are especially critical for exporters, where meeting environmental certifications becomes part of staying competitive in international tenders.

While environmentally aligned tooling helps differentiate premium European brands, the transition adds complexity. Costs tied to waste heat recovery, water treatment, and emissions tracking systems are increasingly factored into pricing, not just for finished tools but across the entire carbide supply chain.

How This Affects European Toolmakers and Buyers

The 2025 surge in tungsten carbide pricing is already impacting day-to-day operations throughout Europe’s manufacturing sector. The effects are evident in tighter margins, changing procurement strategies, and greater value retention focus. Firms are thus revisiting long-term vendor relationships, patterns of tool usage, and just-in-time inventories to place a hedge against future volatility. This is how the impact is playing out along the supply chain:

Rising Production Costs

The toolmakers who used to rely on solid carbide blanks or tipped components are facing increased input prices. Increases in the cost of raw materials impact every stage of production and actually ripple from the acquisition of the powder through grinding, coating, and finishing.

This isn’t a one-off adjustment. Many European firms are now revising cost models across their SKUs, particularly for high-volume end mills, inserts, and micro tools. When carbide becomes more expensive to work with, companies must decide whether to absorb the impact or restructure product lines around profitability.

Common adjustments include:

- Increasing batch sizes to improve production efficiency

- Reducing product variety to streamline tooling operations

- Prioritising SKUs with higher margins or strategic importance

- Switching to coated HSS or cobalt options for less demanding jobs

- Passing incremental costs onto distributors or OEM customers

These changes are already visible in catalog updates and pricing strategies across the tooling sector.

Supply Chain Risks

With tighter global output and export limits, availability is no longer guaranteed. European manufacturers are encountering delays in sourcing specific carbide grades, blank dimensions, and coated tool variants.

Lead times have become harder to forecast, especially when relying on international partners. Disruptions upstream are now forcing buyers to either stock more than usual or risk production gaps. This environment demands better supplier diversification, real-time tracking, and tighter integration between procurement and planning teams.

Pressure on Pricing and Delivery Timelines

All tool buyers, whether they are resellers or distributors, or machine shops, are feeling the squeeze. Cost increases can’t always be easily passed down the line and may not be possible where there are contracts in place and customer expectations have been firmly anchored to last year’s pricing.

At the same time, delivery timelines are under stress. Delays in carbide input can shift entire delivery calendars, forcing sales teams to renegotiate expectations and operations to buffer more inventory. Staying competitive now means more agility in lead-time communication and pricing strategy.

Strategic Adjustments Manufacturers Might Make

European tooling companies aren’t standing still. Many are already adapting, exploring alternate sourcing, increasing inventory buffers, or shifting toward product families that use less carbide.

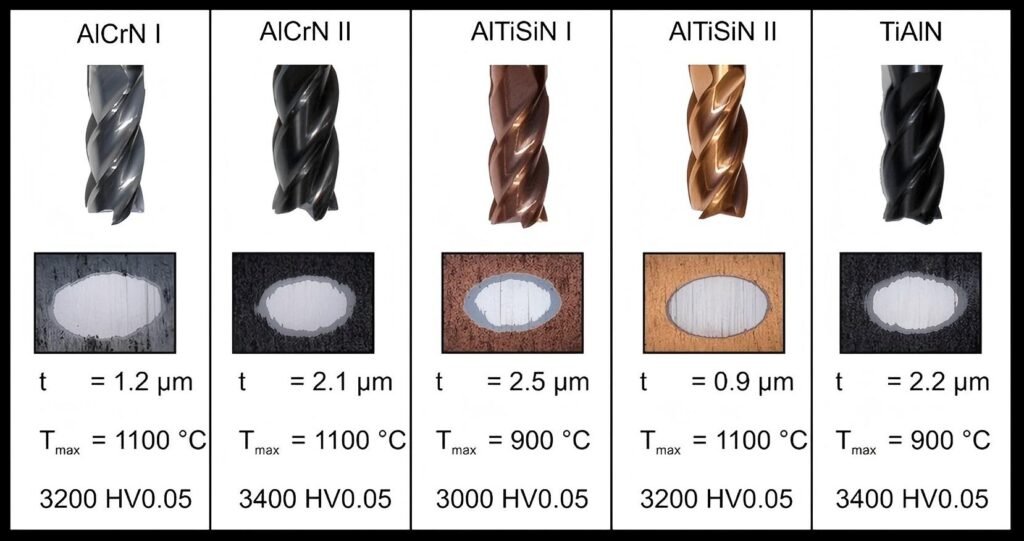

Some firms are also turning to technology, testing high-performance coatings like AlCrN to reduce wear and extend tool life, effectively getting more from every gram of carbide. Others are ramping up recycling initiatives, collecting spent tools, and reclaiming usable tungsten through certified partners.

Adjusting early can help manufacturers ride out volatility while strengthening their reputation for reliability.

What Can the Industry Do in Response?

Rising tungsten carbide prices are tough, but they also come with good news. European toolmakers who are thinking ahead can still be profitable, make their businesses more efficient, and be competitive.

Smart Sourcing and Inventory Planning

The marketplace has gone through considerable transformations. The reactive purchasing approach is no longer suitable in the changed marketplace. Toolmakers are currently cooperating with suppliers so that they can make multi-year contracts, discuss forage prices, and decide on the buffer stock for the critical carbide grades and sizes that they will need in the future.

Just a slight increase in the quantity of stock can go a long way in preventing large delivery disruptions. The use of digital procurement platforms and the improvement of demand forecasting, primarily for items such as 1 2 carbide end mill blanks or pre-formed carbide drill bits for hardened steel, for instance, will be able to even out the fluctuations in the prices of the products. A few companies are, additionally, getting into collaborative agreements with other companies in different regions in order to share stock among themselves and lessen reliance on any one single source of supply.

Taking a proactive approach to procurement means having more power. Producers can be assured that if they strengthen their relationships with recyclers, sinterers, and blank suppliers that they will be able to cover all eventualities, such as sudden price changes or material shortages in the future without having to halt the production of their goods or reduce the value of the finished parts.

Material Optimisation and Recycling

2025 has seen a rise in interest around carbide recycling. The global carbide recycling market reached approximately USD 1.28 billion in 2024, and demand is projected to expand by over 8% annually through 2033.

Recycling lets Europe-based makers get back tungsten from used tools, scrap ends, and broken parts. Advanced recycling help and closed-loop plans from suppliers like Global Tungsten & Powders in Europe are bringing nearly 90% of material value back; it lowers the need for new powder.

This implies lowering net tungsten imports, controlling blank costs, and positive sustainability messaging. Upfront investment in collection and sorting systems pays off in reduced procurement risk and positions firms ahead of tightening environmental regulations.

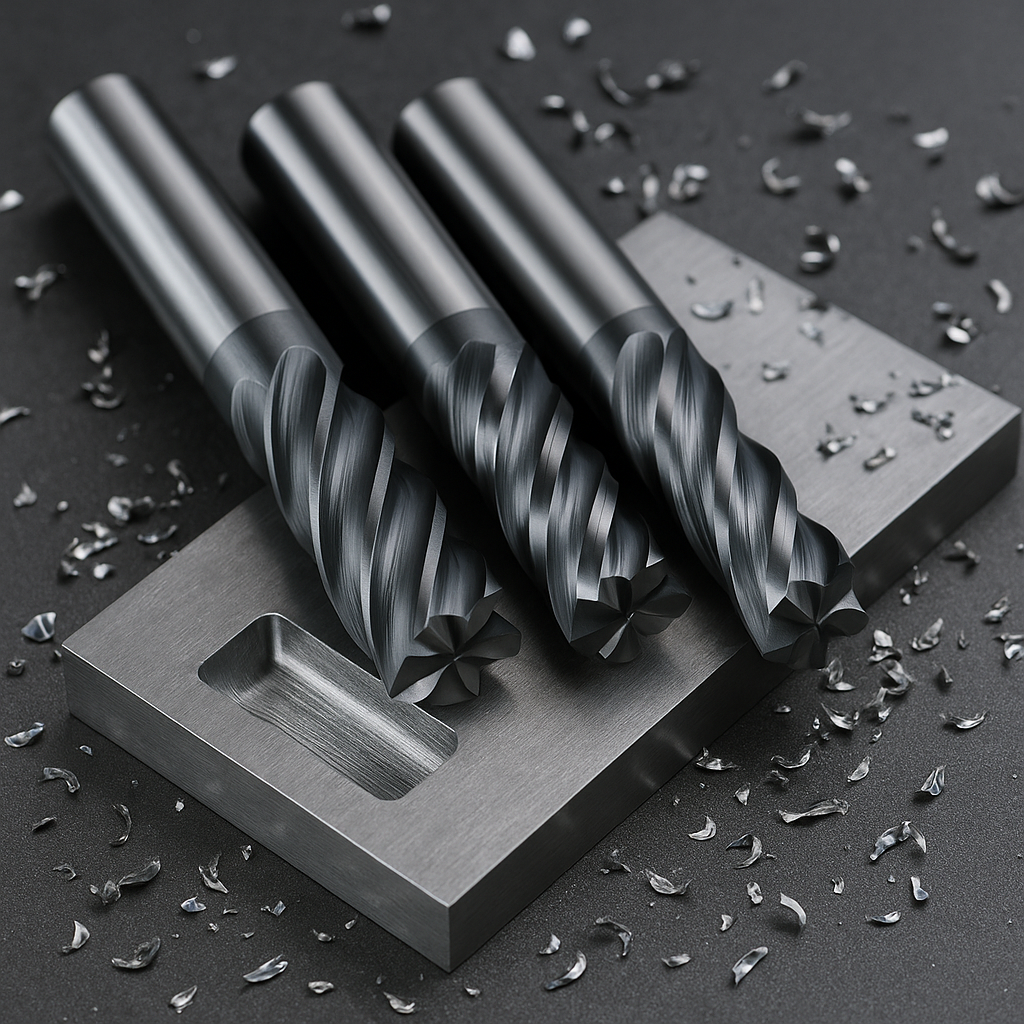

Investing in Advanced Tool Technology and Coatings

When the price of raw materials goes up, then tools have to get more value from every gram. European toolmakers are at the forefront here, and they are extending the use of premium coatings, such as AlCrN, TiAlN, and DLC, in order to decrease the consumption of carbide per part while at the same time increasing wear resistance.

Additionally, substrate innovation is being introduced. Superior equipment, although it may cost more per unit, makes up through longer tool life, fewer changeovers, and better part accuracy. For manufacturing operations in Germany and Swiss CNC hubs, this retains margins even if fuel and raw material prices spike.

Conclusion

Tungsten carbide remains a foundation of precision machining across Europe. Its rising price has brought fresh challenges to manufacturers and tooling suppliers since 2025. Between tightening export controls, surging energy costs, and shifting demand, staying idle is not an option.

Firms that put money into good sourcing plans, take on recycling programs, and change to advanced tools are more ready to adjust. The right choices now can protect your business from doubt and make it stronger for the future.

HN Carbide is here to help you make those moves. From durable carbide end mill cutters to optimized drill tools for hardened steel, we deliver performance-focused solutions designed for modern European machining. Our custom tooling, responsive support, and industry-grade tolerances help you stay ahead, whatever the market throws your way.

Limited Stock Available – Lock in Today’s Prices

At HNCarbide, we still maintain a small amount of ready stock that is not affected by recent tungsten carbide price surges. If you are interested, please contact us to secure your order while supplies last.