Beyond Price Tags: The China End Milling Cutter Manufacturer Playbook

When sourcing from China, the biggest cost risk is rarely the end milling cutter price on the quotation sheet. It’s the “hidden cost” of inconsistent batches: unstable tool life, unexpected runout, coating variability, and rework on your side.

This guide is written for distributors, importers, and private-label brands who need a repeatable way to qualify a china end milling cutter supplier—especially for solid carbide end milling cutter series (55HRC/60HRC/65HRC) and selective HSS milling cutter end mill programs.

You’ll get:

- A practical requirement definition framework

- A manufacturer vs traderidentification method

- A core QC checklist (the part that actually prevents bad batches)

- A copy-paste question list you can send today

- A fair sampling strategy that avoids “test bias”

- Wholesale details (MOQ, packaging, labeling, support)

- A transparent price breakdown

Naturally, you’ll see the terms end milling cutter, milling cutter end mill, end milling cutter manufacturer, and china end mill milling cutter where they genuinely fit.

Define your requirement

Before you ask for “best price,” lock down what “acceptable” means for your market. Most sourcing problems come from vague requirements like “carbide end mill for steel.”

Define these items first

- Work material range: aluminum / carbon steel / alloy steel / stainless / cast iron / titanium

- Target hardness & series: 55HRC general-purpose, 60HRC stainless focus, 65HRC hardened steel

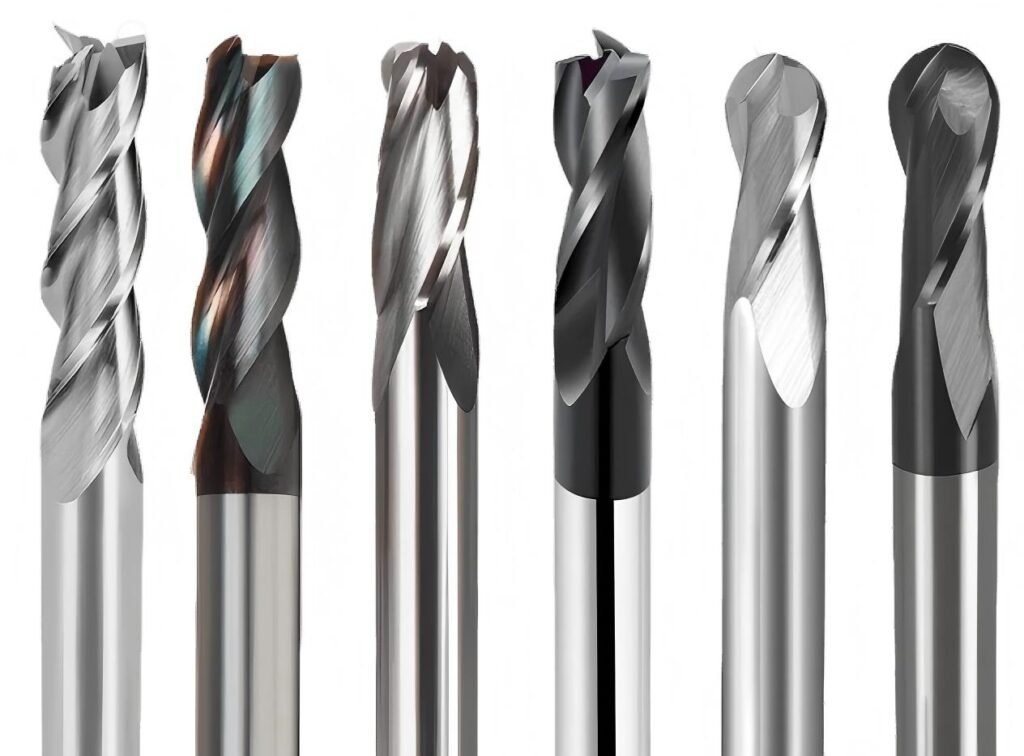

- Geometry: 2F/3F/4F/5F; helix angle; corner radius vs square; necked/long-reach

- Coating strategy: uncoated for non-ferrous, TiAlN/AlCrN class for steels, etc.

- Shank & standard: Weldon flat / DIN 1835 form, cylindrical, reduced shank (this affects holder security and complaints later)

- Packaging & marking: laser marking content, barcode/SKU, tube vs plastic box vs color box, label language (EN/DE), anti-rust handling

If you sell to multiple segments, define “tiers” instead of one spec:

- Tier A (production): tight runout, stable coating, inspection reports

- Tier B (job shop): good consistency, moderate inspection

- Tier C (value): basic checks, simpler packaging

That way you can keep one end milling cutter supply chain, but with controlled expectations.

Manufacturer vs trader: how to identify a real end milling cutter manufacturer

A true end milling cutter manufacturer should be able to show process control, not just catalog pictures.

What a real factory can usually demonstrate

- Grinding capability: modern CNC tool grinders (multi-axis), consistent wheel management, controlled edge prep

- Inspection capability: runout measurement, tool presetting, optical measurement; at least basic traceable inspection

- Coating route: in-house PVD or stable partner with documented coating specs (thickness targets, temperature windows)

- Batch discipline: lot numbers, incoming carbide rod checks, in-process checks, outgoing sampling

- Evidence of standards awareness: shank types like Weldon flats associated with DIN 1835 variants (often referenced in industrial tooling catalogs)

A quick comparison table

What you check | Real manufacturer (best case) | Trader (typical risk) | What you ask for |

Production proof | Shop-floor photos/video with machines running + date | Stock images, mixed brands | “Show today’s grinding + inspection video with date card.” |

Inspection reports | Can provide per-batch or per-lot records | Often cannot or forwards generic PDFs | “Provide last 3 batch reports for the same SKU.” |

Coating control | Thickness targets, partner name, process notes | “AlTiN available” only | “What’s coating thickness target and how measured?” |

Traceability | Lot numbers on boxes + internal batch codes | No consistent batch ID | “How do you trace a complaint to a rod lot?” |

Technical answers | Specific, consistent across calls | Changes each time | Ask the same question twice, 1 week apart |

If you’re buying wholesale end milling cutter quantities, treat “traceability + repeatability” as non-negotiable. Price only matters after stability is proven.

Core QC checklist

This is the checklist that reduces the risk of receiving a “good sample but unstable production.”

Raw material and batch traceability

For solid carbide end milling cutter series, the substrate is the foundation.

You want:

- Carbide rod lot identificationtied to production date and SKU

- Incoming checks (at least basic): rod diameter consistency, surface defects, straightness (as applicable)

- A complaint workflow that can map a failed tool back to a batch ID

Grinding consistency (size, runout, edge)

Runout is one of the fastest ways to turn a “good” end mill into a bad user experience: chatter, poor finish, unpredictable tool life.

Some high-precision tool makers publish extremely tight runout/OD tolerance claims on micro tools (e.g., ±0.002 mm class claims exist in premium micro-tool literature), which shows what’s achievable with strict control and metrology.

You don’t always need that extreme level—but you do need consistent, documented control that matches your product tier.

What to control and record

- OD toleranceby diameter range

- Shank diameter & cylindricity

- Runout at a defined gauge length(define where and how it’s measured)

- Edge prep(micro-chamfer/hone): too sharp chips early, too heavy increases cutting forces

- Flute symmetry & core thickness consistency(strength vs chip evacuation)

Coating consistency (thickness, adhesion, repeatability)

For steel/hardened steel programs, coating variation is a top complaint driver.

In cutting tools, PVD coatings are commonly in the ~3–5 μm range depending on coating type and target application, and published sources frequently cite thickness targets around this range.

If a supplier can’t clearly state a thickness target and control method, you’re guessing.

What to specify

- Coating family (e.g., TiAlN / AlCrN class) and application intention

- Thickness target (per series)

- Adhesion expectation (how they validate; even if it’s “partner provides adhesion testing,” you need a method)

- Edge build-up control (thicker isn’t automatically better if it ruins sharpness)

Sampling rules + defect handling

Even a decent factory can ship bad batches if the outgoing inspection is weak.

Define:

- Sampling plan: e.g., per lot / per size / per coating run

- Critical-to-quality (CTQ) items: runout, OD, coating, flute damage, marking

- Defect classification: critical / major / minor

- Disposition: rework, sort, replace, credit, expedited remake

- Time limit: how many days after receipt you can file claims

QC checklist table (use this as your acceptance backbone)

QC Item | What “good” looks like | How it’s verified | Typical failure symptom |

Traceability | Lot/batch ID links SKU → production → rod lot | Packaging ID + internal record | “Same SKU, different performance” with no root cause |

Runout control | Defined max runout at defined gauge length | Dial indicator / presetter check | Chatter, poor finish, early chipping |

OD consistency | Stable OD within your tier tolerance | Optical measurement / micrometer | Size out of spec, inconsistent slot width |

Edge integrity | No micro-chips; consistent edge prep | Microscope spot check | Random chipping, short tool life |

Coating thickness target | Series-specific target (often ~3–5 μm class for PVD tools) | Coating partner report / thickness method | Fast wear, color inconsistency, “coating peeling” complaints |

Coating adhesion process | Documented pre-cleaning + controlled process | Process record + partner QA | Flaking, poor wear resistance |

Outgoing inspection discipline | Sampling plan + records per batch | QC report | “Great sample, bad production” |

Sampling strategy: how to test fairly

A fair test removes variables unrelated to tool quality.

Choose 3 representative jobs

- Aluminum(chip evacuation + edge sharpness + built-up edge behavior)

- Steel(coating + substrate + edge prep balance)

- Difficult material(stainless or hardened steel) to validate the “premium” series claim

Record consistent metrics

- Tool life (time, distance, or parts count)

- Surface finish stability

- Wear pattern (flank wear vs chipping vs notch wear)

- Failure mode (sudden break, gradual wear, edge chipping)

Control the variables

- Same machine (or same class), same holder, same stick-out

- Same CAM strategy, same feeds & speeds, same coolant mode

- Same operator setup method

A simple test matrix table

Material | Tool series to test | Operation | Key metric | Pass signal |

Aluminum | 2F/3F uncoated or suitable non-ferrous geometry | Slot / pocket | Finish + chip control | No built-up edge issues, stable finish |

Steel | 4F/5F coated (55–60HRC class) | Side milling | Tool life + wear pattern | Predictable wear, low chipping |

Stainless / Hardened | 60–65HRC coated series | Finishing / contour | Edge stability | No sudden chipping, stable size |

If the supplier pushes only a single “universal” tool for everything, be cautious. Real product lines exist because applications are different.

Wholesale details: MOQ, packaging, labeling, and support

For wholesale end milling cutter sourcing, “commercial readiness” matters as much as engineering.

MOQ structure (good practice)

- Lower MOQ for mixed sizes within one series

- Clear price ladders by quantity

- Stable private-label process (artwork approval → sample → mass production)

Packaging & labeling

- Individual plastic tube for safety (baseline)

- Optional plastic box or color box for retail/brand positioning

- Laser marking content: diameter, flute count, coating, series (55/60/65), batch ID

- Barcodes/QR: should map to your internal SKU system

Support

- Recommended parameters per series (even a basic guideline reduces returns)

- Complaint handling SLA: response time, remake timeline, evidence requirements

If you’re building a brand, insist the batch ID is not optional—because it’s the key to solving problems without arguments.

Price breakdown: what really drives end milling cutter price

If you want to negotiate professionally, you need a realistic cost model.

The biggest drivers usually are:

1.Carbide grade / rod stability (premium substrate costs more but reduces variability)

2.Grinding time & process control (tighter runout/OD means more control, more inspection, more scrap risk)

3.Coating type + consistency (PVD process control, thickness targets, partner quality; PVD thickness is often discussed around a few microns for cutting tools)

4.Inspection intensity (more checks = fewer bad surprises)

5.Packaging & marking (laser + custom box + barcode systems add cost but reduce downstream confusion)

A practical “cost driver” comparison table

Cost driver | Low-price behavior | Stable wholesale behavior | What you should demand |

Substrate | Unclear rod source | Defined rod lots + records | Batch traceability |

Grinding | Minimal checks | Runout + OD + visual standards | Report samples |

Coating | “Any color” promise | Defined coating + thickness target | Coating documentation |

Inspection | End-only look | In-process + outgoing sampling | Sampling rules |

Packaging | Generic tube | Brand-ready labeling | Batch ID + SKU mapping |

If a quote is 30% lower, ask which of these got reduced. Most of the time, you’ll find the answer.

Conclusion: a low-risk sourcing path for China end mills

A smart sourcing route for china end mill milling cutter programs looks like this:

1.Small-batch validation: 3 materials, controlled parameters, documented results

2.Stabilized batch order: lock key CTQs (runout method, OD tolerance, coating target, batch ID)

3.Annual framework: planned forecasts, stable pricing bands, continuous improvement loop

Do this, and your supplier becomes a controllable production partner—not a gamble hidden behind a cheap end milling cutter price.

FAQ

How do I verify a China end milling cutter manufacturer?

Ask for dated shop-floor proof (machines + inspection), real batch inspection reports, and a traceability method (batch ID). Also verify whether they run a documented QMS such as ISO 9001 (and confirm the certificate scope).

What QC documents should I ask for?

Request a recent batch report showing at least OD, shank, runout measurement method, visual checks, and coating information (where applicable). If coated tools are involved, ask for coating thickness targets and verification approach.

What affects end milling cutter price the most?

Substrate stability, grinding consistency (runout/OD control), coating process control, and inspection intensity are usually the biggest drivers—more than “material cost” alone.

What affects coated tool consistency the most?

Coating thickness targets, pre-treatment/cleaning discipline, and stable process control. Published sources commonly describe PVD cutting tool coatings in the few-micron range, so uncontrolled variation can cause noticeable performance swings.

Is HSS milling cutter end mill still worth it?

Yes—especially for lower speed machining, less rigid setups, resharpening programs, and cost-sensitive maintenance work. It’s not “obsolete,” it’s application-dependent.

What’s a reasonable MOQ for wholesale end milling cutter?

It depends on series and customization. A reasonable structure is a lower MOQ for standard catalog SKUs and a higher MOQ for custom geometry/packaging. The key is to tie MOQ to batch traceability and consistent outgoing inspection.

Should I prioritize Weldon shank / DIN-style flats for wholesale?

If your customers commonly use side-lock holders, Weldon flats can improve clamping security and reduce slip complaints. Many industrial catalogs reference DIN 1835 form variants for cylindrical shanks with flats, so align the shank style with your buyer’s holder ecosystem.

What’s the biggest “red flag” during sampling?

A supplier who refuses to define how runout is measured (method + gauge length) or who can’t provide real batch records. Great samples without documented control often lead to unstable production.